How to open Stock Market (COLFinancial) Account if you are an OFW

One of the ways to grow your money is by investing in the stock market. Gone are the days na mayayaman lang ang nakakapag-invest dito. Ito yung mga times na para makabili ka ng stocks na gusto mo, tatawag ka pa sa broker mo using your landline. But when the Online Brokerage started at naging maliit na halaga na lang ng pera ang kailangan to open an account, nagkaroon ng opportunity ang mga karaniwang tao sa pag-invest sa stock market. Ito rin yung mga panahong wala pang internet or mahal pang magpakabit ng internet.

Pero ngayong nasa digital at information age na tayo, affordable na ang internet and almost everyone has access to internet, pwede mo nang maaccess ang stock account mo anywhere basta online ka. Sa online, hindi mo na kailangang tumawag pa sa broker mo para bumili at magsell ng stocks. You just need to click BUY and SELL button, and wallah, you are trading IN and OUT na sa market.

*Please note that I’m not part of or connected with COLFinancial company. I’m sharing this to you as a user of their online platform and someone who experienced using their system.

Here are steps on how to open an account with COL Financial, the leading online stock market brokerage in the Philippines.

So let’s get started.

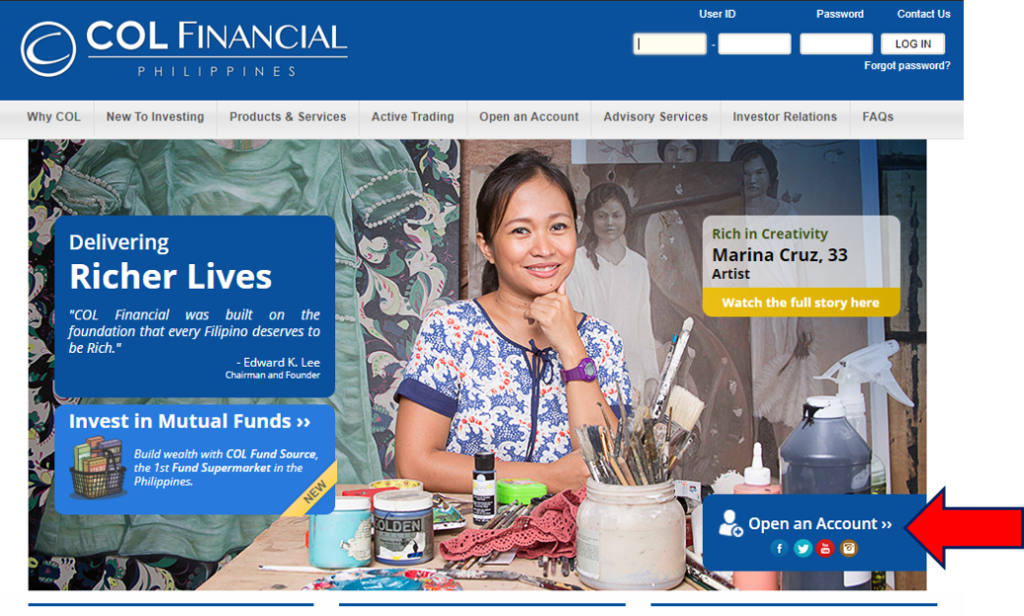

1. Go to www.colfinancial.com

2. Click on Open an Account at the bottom right side of the profile picture.

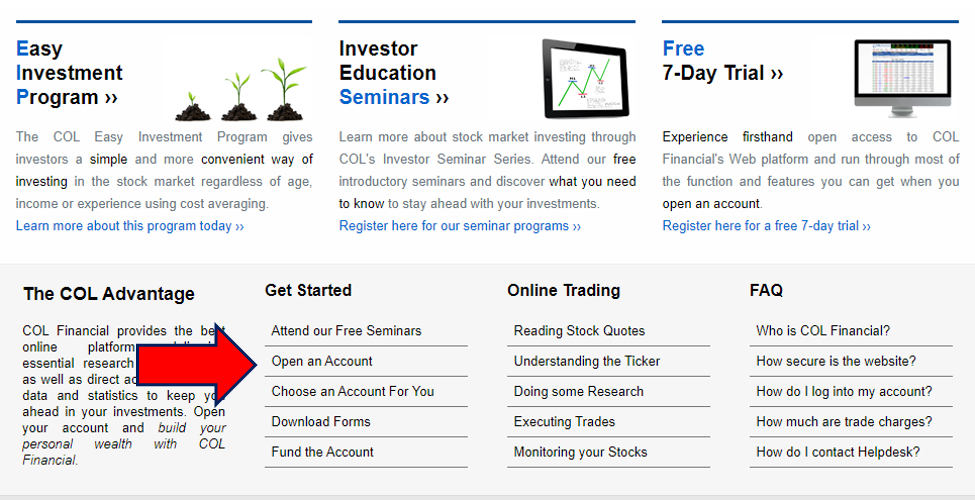

Or you can select Open an Account under Get Started.

3. Choose your account type

You will see the differences between these three from this table:

4. Fill out all application forms

You can download all the forms from this link:

5. Prepare additional documents

The following are the requirements you need to submit.

FILIPINO CITIZENS

- Photocopy of one (1) valid government issued ID

Photo and signature must be clear

RESIDENT FOREIGN CITIZENS

- Photocopy of one (1) valid government issued ID

Photo and signature must be clear - Alien Certificate of Registration (ACR)

or Work Permit from DOLE

NON-RESIDENT FOREIGN CITIZENS

- Photocopy of one (1) valid passport

Photo and signature must be clear

IN-TRUST-FOR (ITF) ACCOUNTS

- Photocopy of one (1) valid government issued ID of the parent

Photo and signature must be clear - Birth Certificate of the minor applicant

6. Submit forms and requirements

- You need to scan the filled-out forms and then send the scanned copy to helpdesk@COLFinancial.com. This is to verify if all the details and entries are properly entered. Minsan kasi mali ang mga naisusulat ng mga mag-oopen ng account kaya i-check muna nila.

- After verification and everything is complete, they will request you to send the correct and completed forms and requirements via courier (i-Remit, LBC, DHL, Fedex etc.)

- Once they receive your documents, a sales officer will review your application and schedule a video conference call(Skype, FB Messenger, Viber etc.) for information verification.

- Or you may personally submit originally signed forms and clear ID documents to COL Financial when you go for vacation.

- You may send the originally signed forms to COL Financial’s Business Center.

Their Addresses are:

COL Business Center

2403B East Tower, PSE Centre,

Exchange Road, Ortigas Center,

Pasig City 1605, Philippines

(+632) 651 5888

COL Investor Center – Makati

Ground Floor, Citibank Tower,

Valero corner, Villar Streets,

Makati City 1227, Philippines

(+632) 478 2954

(+632) 478 3316

(+632) 478 3275

COL Investor Center – Davao

2nd Floor Robinsons Cybergate,

J.P. Laurel Ave., Bajada,

Davao City 8000, Philippines

(+6382) 287 8192

(+6382) 287 8193

(+6382) 287 8194

*Reminders from COL when sending your documents:

7. Fund your account

You don’t need large amount of money to fund the account. For as low as P5,000.00, pwede ka nang makabili ng stocks na gusto mo.

ONLINE BILLS PAYMENT

- Bank of the Philippine Islands (BPI)

Click here for instructions ›› - Banco de Oro (BDO)

Click here for instructions ›› - Metrobank

Click here for instructions ›› - Asia United Bank

Click here for instructions ›› - Chinabank

Click here for instructions ›› - Robinsons Bank

Click here for instructions ›› - Unionbank

Click here for instructions ››

OVER-THE-COUNTER BILLS PAYMENT

*Please see Bank Service fees here

- Bank of the Philippine Islands (BPI)

View sample payment slip ›› - Banco de Oro (BDO)

View sample payment slip ›› - Metrobank

View sample payment slip ›› - Asia United Bank

View sample payment slip ›› - Robinsons Bank

View sample payment slip ›› - Unionbank

View sample payment slip ››

click here for complete instructions

COL BUSINESS CENTER

- 2403-B East Tower, PSE Centre

Exchange Road, Ortigas Center,

Pasig City, Philippines 1605

OVERSEAS REMITTANCE

- BDO Kabayan Bills Bayad (click here for BDO’s website)

The option has the following benefits:- Crediting time is within 1-3 business days

- Less Charges

- No need to send a receipt to COL Financial

- Click here for instructions ››

- iRemit (iremitx.com)

Click here for instructions ›› - BDO Overseas Remittance

Click here for instructions ››

*All checks must be payable to COL FINANCIAL GROUP, INC. Please include your Name and COL Account No. at the back.

If you want to check how do I fund my COL account, kindly check this link.

8. Stock Account is ready and activated (last and very important thing to do).

Yes. COL account officer will send you an email mentioning your ACCOUNT NUMBER together with the initial password.

It’s very important that you change the initial password with a PASSWORD of your own once inside COL platform. This is to make sure that you are the only one who can access your account.

There you go! Congratulations for opening your stock market account. You now belong to the 1% of Filipinos who invest in the stock market. But it doesn’t end there. Your journey is just beginning. You have lots of things to learn. It’s not only clicking the BUY and SELL button. In my next blogs, I will share basic things on how to buy and sell stocks the right way.

Best of luck to your journey!

For more tips on saving money, money management, investments and business, please subscribe to my blog.